Here are some of the corporations that are struggling to keep up with the times. Will this affect Merced County?

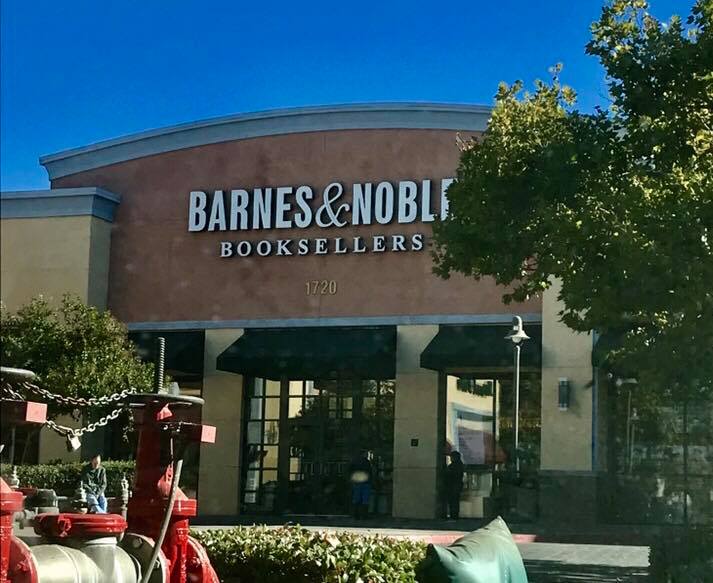

BARNES & NOBLE:– The bookstore giant, which has more than 630 locations in the United States, is the last national bookstore competing with Amazon.

In a desperate effort to compete against Amazon, Barnes & Noble attempted to compete with their own version of a online E-Reader; the company reportedly lost over $1 billion dollars.

To make matters worse, Amazon has opened a total of 17 book stores in the United States.

According to one analysts, another problem Barnes & Noble has is people tend to come in to read a book/magazine, and leave without buying.

Source- Buisnessinder.com

RITE AID: Rite Aid is currently in 4th place behind bigger and better retail pharmacy chains: CVS Corporation, Walgreens, and Walmart.

Rite Aid currently sits on $3 billion in debt. To make matters worse Walgreens recently bought more than 1,900 Rite Aid stores for $4.2 billion, giving Walgreens 9,964 U.S. locations, leaving Rite Aid with roughly about 2,533 store locations.

Another headache for the Rite Aid Corporation is Amazon’s purchase of PillPack, an online pharmacy the lets users buy medications in pre-made doses. Amazon reportedly purchased PillPack for just under $1 billion.

Source- Forbes

J.C. PENNEY’S : J.C Penney’s combined long-term and short-term debt totals more than $4 billion.

Management has reduced debt by about $600 million in the past fiscal year. Last year JC Penny’s closed more than 130 stores.

JC Penny’s has roughly 860 stores left in the United States, including Puerto Rico.

Source: Forbes.com

PETSMART INC: The largest U.S. pet retailer, has hired restructuring advisers to explore ways to trim its massive debt of more than $8 billion.

Pet smart is attempting to compete with Amazon after acquiring Chewy.com last year for $3.35 billion – the highest price ever paid for an e-commerce site.

It was a bold move, with Pet Smart adding $2 billion to its debt load to do the deal. According to reuters.com, the deal has yet to pay off.

Source- Reuters.com

NOTABLES:

CLAIRE’S: The teen accessories retailer, well-known for its ear-piercing service, filed for bankruptcy protection in March 2018. Claire’s has been unable to make good on its debt obligations after a private equity firm took the company private as part of a $3.1B leveraged buyout in 2007. This represents the latest retailer to be brought down by a combination of private equity debt, and e-commerce competition. Claire’s is currently negotiating with its lenders to reduce its debt as it continues to operate its retail locations.

Children’s Place: Children’s Place currently has about 960 stores, but is planning to close 144 stores by 2020. This is an effort to focus more online, according to the CEO Jane Elfers.